Mortgage pre-approval in the UAE

Are you interested in buying real estate in the UAE? Learn about mortgage pre-approval and why it’s an invaluable part of the property-buying process.

The mortgage process in the UAE

Buying a property is a lifelong dream for many people and the United Arab Emirates (UAE) is a perfect location to consider. With a booming economy and a variety of luxury real estate developments, there are many great opportunities for investors and home-buyers alike. Whether you’re a citizen, an expat looking to relocate, or a non-resident investor, buying a property in the UAE is within your reach. All international and local banks in the UAE provide mortgage loans to nationals and residents. There are fewer options available to non-residents, but working with a trusted mortgage broker increases your chances of finding a personalized loan that works for you.

You can set yourself up for a hassle-free journey to property ownership by familiarizing yourself with the home-buying process from start to finish. One of the first decisions you must make is whether to get a mortgage directly from a bank or through a mortgage broker. Mortgage brokers can generally provide a larger variety of options, especially for foreigners, since they offer loans from multiple lenders. Then, you’ll want to do some research to determine which type of mortgage loan is right for you. A mortgage calculator can help you compare various scenarios and estimate the total loan amount, monthly payments, and price of rent (if you’re considering a buy-to-let property).

Once you’ve chosen a lender and loan type, the next most helpful thing you can do is get pre-approved for a mortgage loan. Continue reading to learn all about mortgage pre-approval in the UAE, the pre-approval letter, conditions, documentation, and the typical length of the process.

What is mortgage pre-approval and why should you get it?

-(1).jpg) So if mortgage pre-approval isn’t a guarantee, why should you get it? First of all, it helps you set your budget so you can narrow down your property search. It may also lock in your initial interest rate (if you’re applying for a fixed-rate loan), protecting you from a potential increase in rates during your property search. Having an official estimate of your maximum loan amount means that you can focus on properties that you can actually afford. This can save you time and disappointment so you don’t consider properties outside of your budget. On Kredium’s property listing website you can input your minimum and maximum price and search over 5,000 properties to find the perfect fit.

So if mortgage pre-approval isn’t a guarantee, why should you get it? First of all, it helps you set your budget so you can narrow down your property search. It may also lock in your initial interest rate (if you’re applying for a fixed-rate loan), protecting you from a potential increase in rates during your property search. Having an official estimate of your maximum loan amount means that you can focus on properties that you can actually afford. This can save you time and disappointment so you don’t consider properties outside of your budget. On Kredium’s property listing website you can input your minimum and maximum price and search over 5,000 properties to find the perfect fit.

Another benefit is that many sellers give preference to buyers that are pre-approved as it shows that they are serious in their intention to buy the property. When a bank pre-approves you, they provide you with an official document verifying the maximum amount they will offer. Having this document on hand when you go to make an offer gives the seller greater confidence that you’ll be approved for the mortgage and that the transaction will occur.

Some banks may charge a fee for processing pre-approval, but for others, getting pre-approved is free. The good news is that, for banks that do charge, the fee is offset by other mortgage-related costs later on making the net cost of pre-approval zero. Getting pre-approved only takes a little extra effort and gives you many advantages as a buyer in the UAE real estate market!

During mortgage pre-approval, the lender seeks to verify that you’re a creditworthy borrower. They examine your financial situation, such as income, debts, and assets, and ensure that you meet all of their lending conditions and requirements. When a lender pre-approves you for a loan, they specify the maximum amount they’re willing to lend you and for what sort of property. Ideally, you should get pre-approved for a mortgage loan before you seriously begin searching for a property. Mortgage pre-approval is also referred to as Approval in Principle (AIP) or in-principle approval.

As the name suggests, this doesn’t give you final, definite approval that the bank will lend you a mortgage loan. Final mortgage approval is usually dependent upon the appraised value of the property. It may be rejected if the property value is lower than expected or the borrower's financial situation changes substantially.

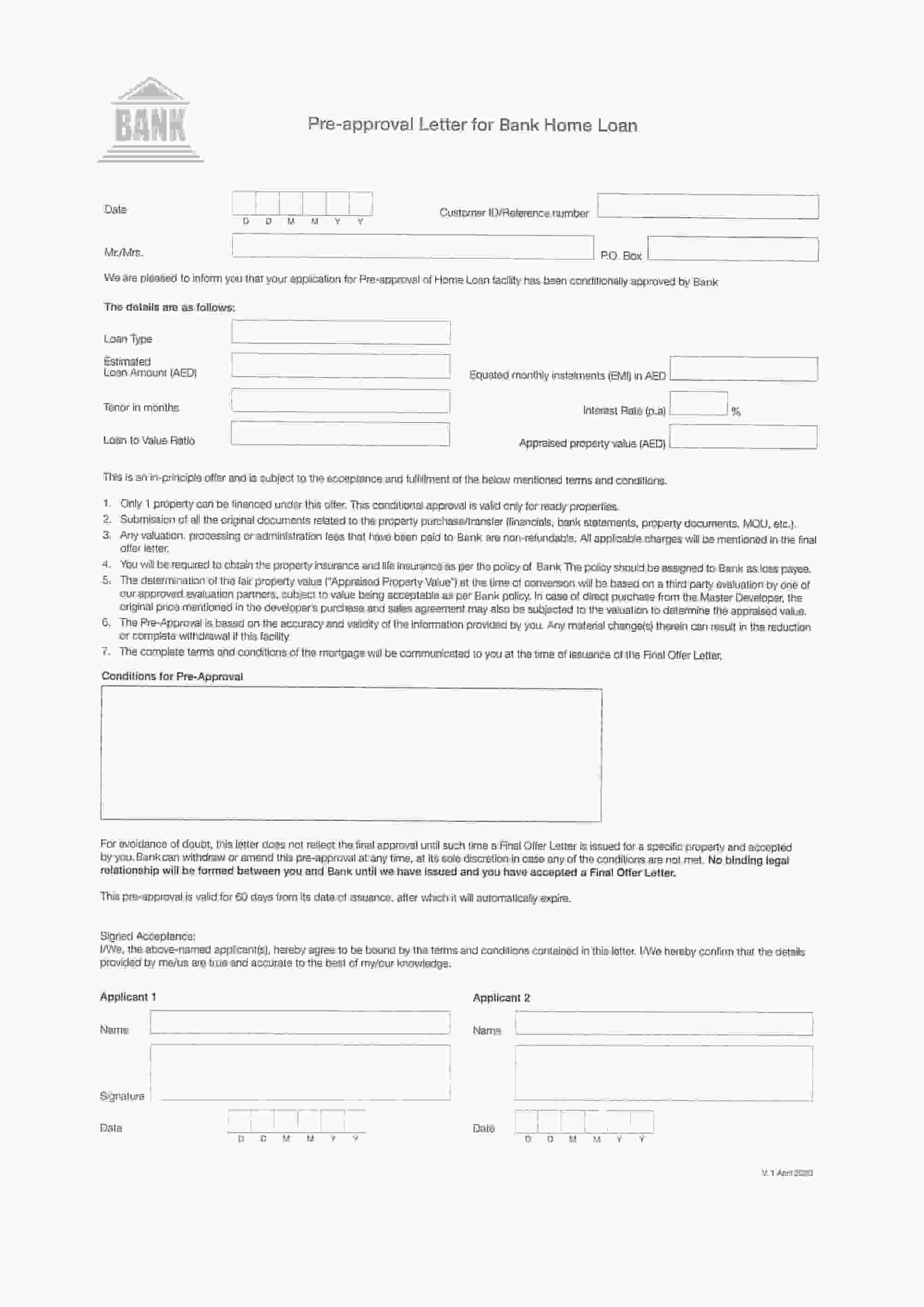

Pre-approval letter example

While each bank will have its own official document for pre-approval, they will more or less have the same information. Let’s take a look at an example of a pre-approval letter.

Included in the loan details section is the loan type, estimated loan amount, tenor in months (or loan term), loan-to-value ratio, equated monthly installments, interest rate, and appraised property value. Below this information, you’ll find the terms and conditions associated with their in-principle offer. They’ll then specify for how long the pre-approval is valid, typically anywhere between 30 and 90 days. You can always reapply for pre-approval if the property search process takes you longer.

Included in the loan details section is the loan type, estimated loan amount, tenor in months (or loan term), loan-to-value ratio, equated monthly installments, interest rate, and appraised property value. Below this information, you’ll find the terms and conditions associated with their in-principle offer. They’ll then specify for how long the pre-approval is valid, typically anywhere between 30 and 90 days. You can always reapply for pre-approval if the property search process takes you longer.

Conditions for pre-approval

Each bank has its own specific mortgage lending conditions, especially when it comes to loans for riskier clients, like non-residents. Here at Kredium, we can present borrowers with mortgage loan options from all retail banks in the UAE. Let’s look at the general conditions for banks in the UAE. Since individual banks may have stricter or more flexible conditions, make sure you double-check the conditions once you decide on a lender and a mortgage loan.

General conditions all buyers must meet:

Employment

If salaried: 6+ months in current job

If self-employed: operating business for 2+ years

May require employment through a well-established institution or government department

Good credit history

Maximum of 50% of income dedicated to repayment

Down payment of 20% or more (15% with national Islamic funding options)

Loan term of up to 25 years

Depending on if you are a UAE national, resident expat, or non-resident, conditions regarding your income and age will vary as follows.

UAE nationals | Resident expats | Non-residents | |

|---|---|---|---|

Salaried income | Minimum income of AED 10,000 | Minimum income of AED 10,000 | Minimum income of AED 25,000 for 3 months* |

Self-employed income | Minimum income of AED 25,000 | Minimum income of AED 25,000 | Minimum income of AED 40,000 for 3 months* |

Age of borrower | 21-70 years of age | 21-65 years of age (up to 70 if self-employed) | 25-65 years of age |

*Non-residents (both salaried and self-employed) can also qualify with an average account balance of AED 25,000 for 3+ months.

Documentation for pre-approval

There are a few personal documents you’ll have to provide for mortgage pre-approval.

UAE nationals: Emirates ID or passport

Resident expats:

Passport or visa

Proof of residence address via DEWA bill or tenancy contract

Non-residents: Valid passport

Regarding income, UAE nationals, and resident expats must provide the same documents while non-residents have additional forms they must submit.

UAE nationals and resident expats | Non-residents |

|---|---|

If salaried:

| If salaried:

|

If self-employed:

| If self-employed:

|

How long does it take to get pre-approved?

Getting pre-approval for a mortgage loan can take anywhere from a few days to a few weeks, usually within 3-25 days. It may take a while to process the pre-approval application and then longer to actually receive the official pre-approval letter via mail or email. The timing can vary greatly depending on your personal and financial circumstances.

The next steps

After you get a pre-approval letter, you can roll up your sleeves and dig into the property search. Find your dream property or investment among thousands of options on Kredium's property listing page, where you can filter by the most popular locations, property type, size, amenities, completion status, and more. Once you decide on a property, you can work with a real estate agent to draft up a Purchase Contract, also known as a Sales and Purchase Agreement (SPA) contract, between you and the owner of the property. Then you can go forward with the mortgage application process to secure the funds for your property purchase. If you’re interested in familiarizing yourself with the Dubai real estate market, read about the Golden Visa scheme, Dubai Land Department (DLD),

title deeds, and the top real estate developers.

In addition to our informative blogs, we have professionals in the UAE that have extensive experience in the market and can give you guidance throughout the entire process. By partnering with the largest real estate developers and lenders in the UAE, Kredium is sure to help you find your dream property and a feasible financing option. Register today or contact our UAE office to see first-hand just how easy we can make the property-buying process!

Photo credits:

Photo by pressfoto | Freepik