Etihad Credit Bureau: Everything You Need to Know

Understanding your credit profile is crucial before applying for a mortgage or buying property in the UAE. The Etihad Credit Bureau (ECB) provides credit reports and scores that lenders rely on to assess your financial eligibility.

Knowing how the ECB works can help you take control of your financial reputation, whether you're an individual preparing to finance your first home or a business looking to secure funding. In this guide, we’ll walk you through everything you need to know, from how the bureau collects data to how your credit score can impact your mortgage approval.

Etihad Credit Bureau – At a Glance

ECB Feature | Details |

|---|---|

Official Name | Al Etihad Credit Bureau (AECB) |

Governing Authority | UAE Central Bank |

Credit Score Range | 300 to 900 |

Who Can Request a Report | UAE residents and nationals |

Correction Request Process | Online via ECB portal or app |

What is The Etihad Credit Bureau?

The Etihad Credit Bureau (ECB) is a federal entity in the United Arab Emirates that compiles credit-related information to create detailed credit reports and scores for individuals and businesses. Established in 2012 and operating under the supervision of the Central Bank of the UAE, the bureau plays a central role in the country's financial ecosystem by offering reliable data that lenders use to check your financial history.

The ECB does not make lending decisions itself. Instead, it provides the tools, like credit reports and scores, that banks, finance companies, and other authorized institutions use to evaluate credit risk before approving loans, mortgages, or other financial products.

Overview

The bureau collects data from various sources including banks, finance companies, and telecom operators. This data includes details about loans, credit card usage, payment behavior, and any defaults or bounced cheques. The information is then combined into a credit report for individuals or businesses, including a credit score number.

Both residents and companies in the UAE are covered by the bureau, and all licensed financial institutions are legally required to report data to it. This ensures that the ECB has a comprehensive view of credit activity within the country.

Regulatory and Operational Scope

The ECB was set up in 2010 and started sharing credit reports in 2014. It works independently but follows rules set by the Central Bank to keep things fair and secure.

Its operations are nationwide, and its services are available to individuals, businesses, and licensed lenders. Institutions use ECB data not only for approving loans and credit cards but also for managing portfolio risk and ensuring compliance with internal lending policies.

What Information Does ECB Collect?

The Etihad Credit Bureau gathers a wide range of financial and credit-related data to build accurate credit reports and scores. This information is used by lenders, landlords, and other authorized parties to check the financial behavior of individuals and businesses across the UAE. The data is submitted regularly and must be accurate, as it directly impacts credit decisions.

The Etihad Credit Bureau gathers a wide range of financial and credit-related data to build accurate credit reports and scores. This information is used by lenders, landlords, and other authorized parties to check the financial behavior of individuals and businesses across the UAE. The data is submitted regularly and must be accurate, as it directly impacts credit decisions.

Data Sources

When it comes to data collection, the Etihad Credit Bureau collects data from a wide range of institutions that are legally required to provide credit-related information. These sources include:

banks,

finance companies,

telecom providers

government-linked entities

Banks and financial institutions are the main sources of credit report data, including information on loans, credit cards, mortgages, and overdrafts. Telecom providers also report on mobile and internet bills, especially if payments are late or missed. In some cases, government bodies like utility companies and courts may add records about unpaid bills, bounced cheques, or financial-related legal cases.

In summary, the ECB collects data from:

banks and finance companies

telecommunications providers

government or semi-government entities (e.g. utilities, courts)

This mix of sources helps the bureau create credit reports that are complete and accurate.

Types of Information

The information collected by the ECB includes both identification and financial behavior. Each individual or business profile begins with core identifying data such as Emirates ID details for residents or trade license numbers for companies. In this way, the credit file can be accurately linked to the right person or entity.

The financial section of the report lists all your current and past loans and credit accounts. It shows the type of credit, how much you still owe, the loan duration, and which bank issued it. It also includes your payment history over the last 24 months, showing any late or missed payments.

In addition to loans and repayment behavior, the report may also include:

instances of bounced cheques

court judgments involving unpaid debts

records of official credit inquiries by lenders

All this information is used to generate credit reports and calculate the credit score, giving banks and other authorized parties a reliable view of someone’s financial standing.

What a Credit Report is and What it Covers

A credit report in the UAE is a record of your borrowing and repayment history, created by the Etihad Credit Bureau (ECB). It includes details about your loans, credit cards, mortgages, and other credit accounts, along with your payment habits, current balances, any overdue amounts, and bounced cheques.

You can get your credit report online through the Etihad Credit Bureau’s website or mobile app.

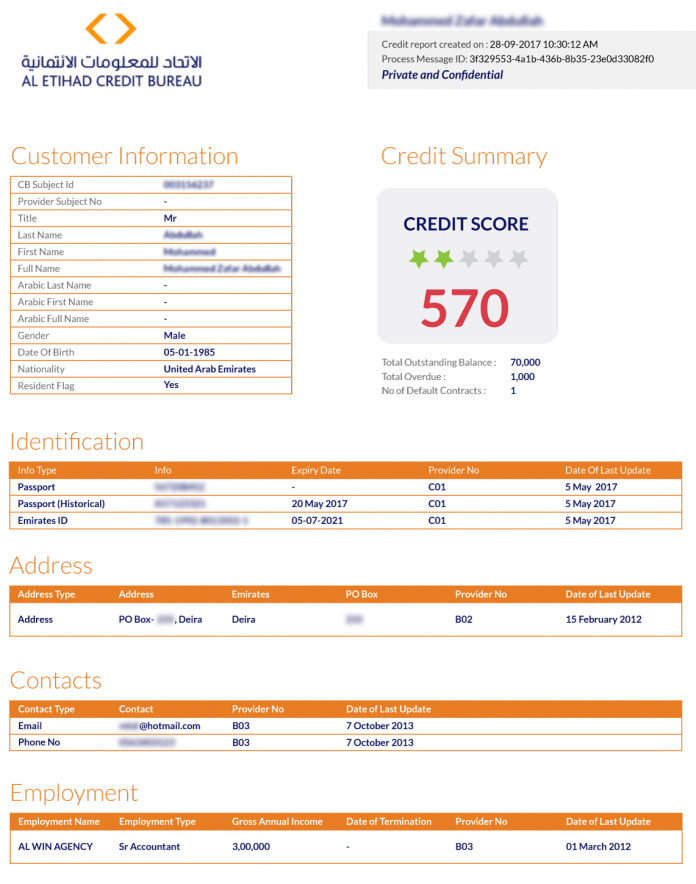

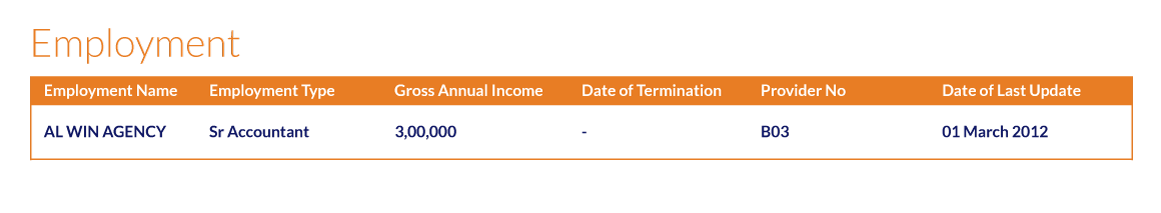

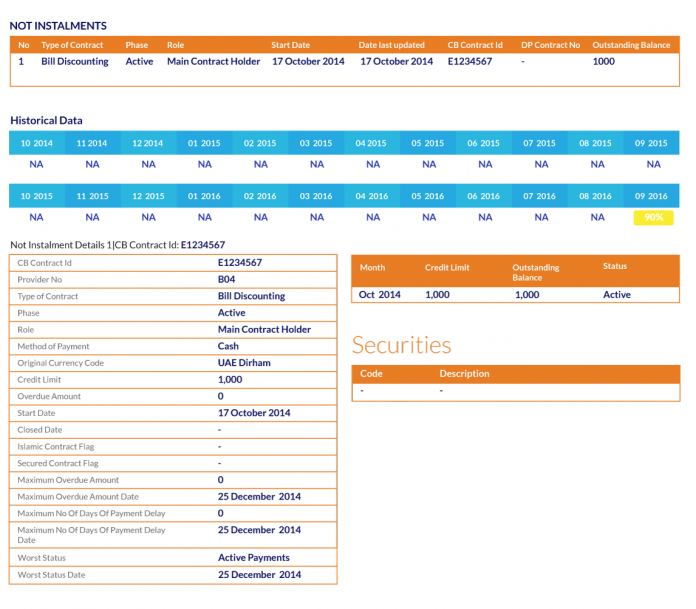

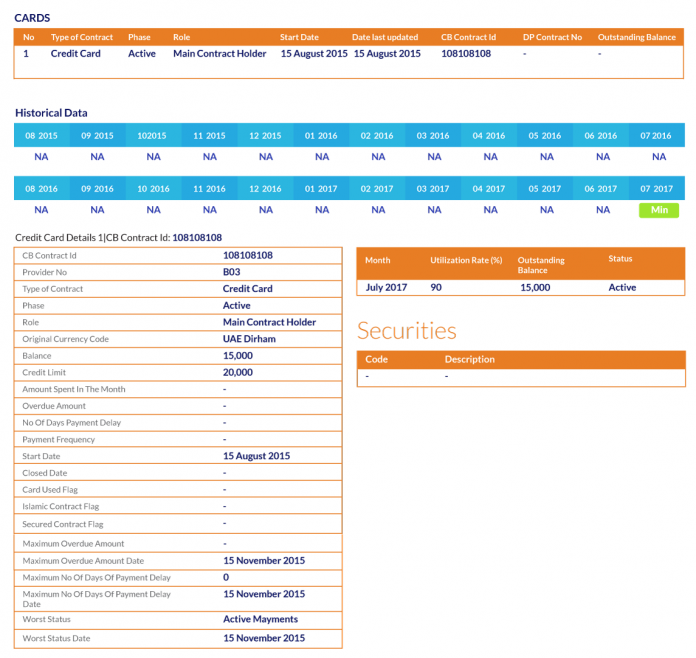

Here’s how a sample credit report looks like:

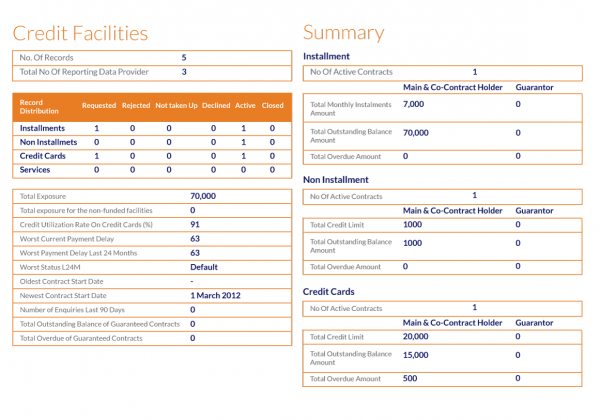

Here’s how the next page looks like in a credit report:

There’s a small fee depending on whether you want just the report or the report with your credit score. You can also visit one of the ECB’s service centers, but doing it online is usually quicker and easier.

Need help getting financially ready for a mortgage? Register with Kredium for expert guidance on your credit report and the best property financing options in the UAE.

Key Details to Look For in Your Credit Report

Your credit report contains several important sections that provide a complete overview of your financial health and borrowing history. Understanding these key details helps you monitor your credit status, identify any discrepancies, and manage your finances better. Below are the essential components you should pay attention to when reviewing your report.

CB Subject ID

This is a unique 9-digit identifier assigned to your credit file by the Etihad Credit Bureau. It ensures your credit information is accurately tracked and referenced.

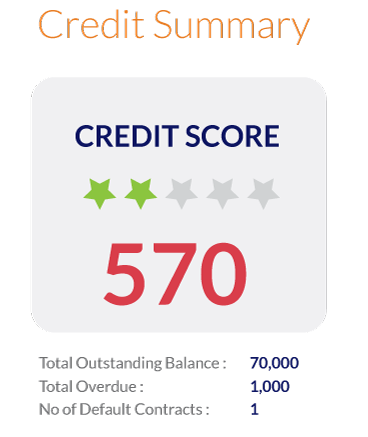

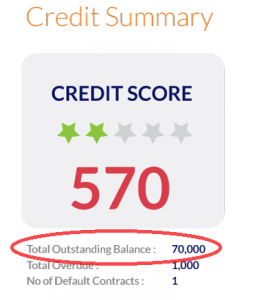

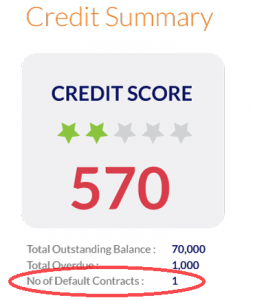

Credit Summary

This section shows your credit score and a star rating that indicates how reliable your credit history is.

Total Outstanding Balance and Defaulted Contracts

The total outstanding balance indicates the amount you currently owe on all credit accounts. Meanwhile, the number of defaulted contracts shows how many loans or credit agreements have missed payments by 90 days or more.

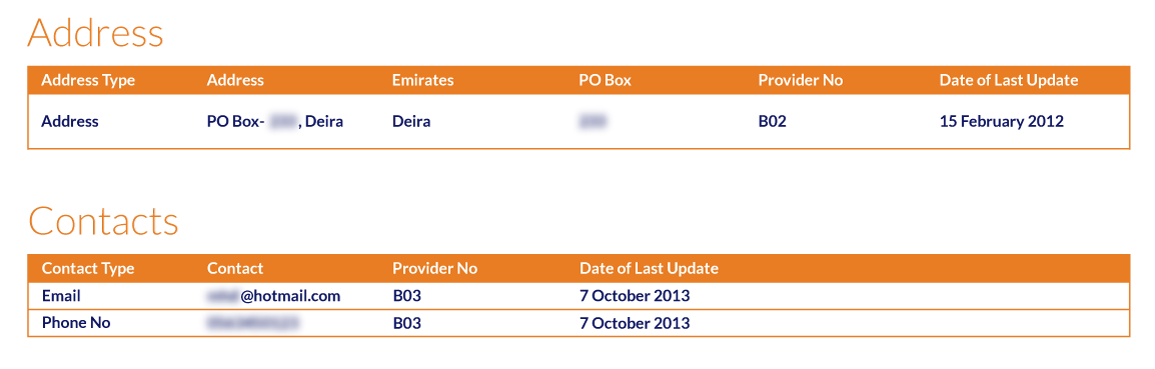

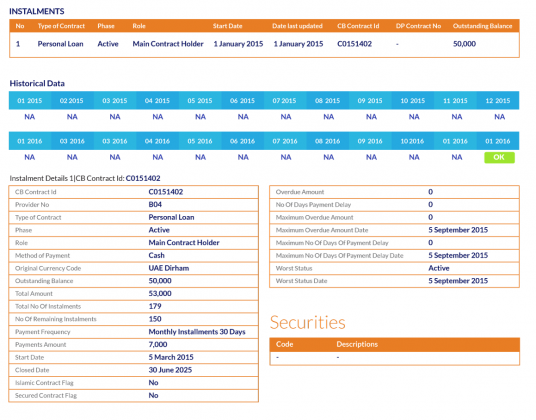

Identification and Contact Information

Your personal identification details such as Emirates ID and passport, along with your current and past residential addresses, phone numbers, and email addresses, are recorded here.

Employment Information

This section lists your current employer, job title, and declared annual income, which help lenders assess your repayment capacity.

Installment and Revolving Credit Accounts

Installment accounts include loans like personal loans, mortgages, or car loans that require fixed monthly payments. Revolving credit refers to flexible credit lines such as credit cards or overdrafts that don’t have fixed payment schedules.

Credit Cards

All credit, prepaid, and debit cards linked to your profile are detailed here, showing their status and activity.

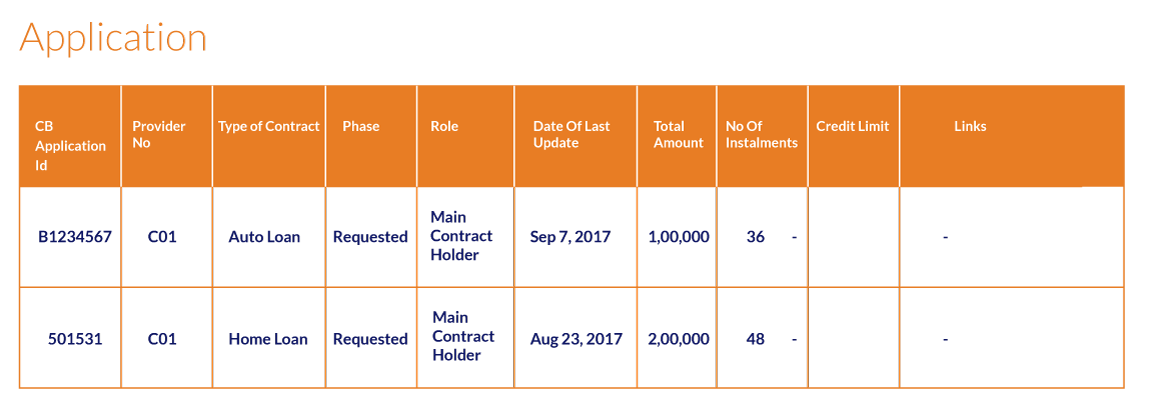

Credit Applications

This part records all your recent loan or credit card applications, including those pending approval or rejected.

How to Check Your Credit Report from Home

Knowing your credit score is a crucial step toward managing your financial health and improving your chances of securing loans or mortgages in the UAE. The Etihad Credit Bureau (ECB) app offers a fast, secure, and convenient way to access your credit score anytime, right from your smartphone. Follow these three simple steps to get started:

Step 1: Log in by Scanning Your Emirates ID

Open the ECB Credit Report app and securely verify your identity by scanning your Emirates ID. This step protects your personal data and ensures that only you can access your credit information.

Step 2: Select “Get Your First Credit Score”

After logging in, tap the “Get Your First Credit Score” option. This feature is designed to give first-time users easy access to their credit score without unnecessary complications.

Step 3: Complete Checkout and View Your Score

You will be prompted to pay a small fee to access your credit score. Once payment is completed, your credit score will be immediately available within the app. Use this information to understand your financial standing and make informed decisions about borrowing or managing debt.

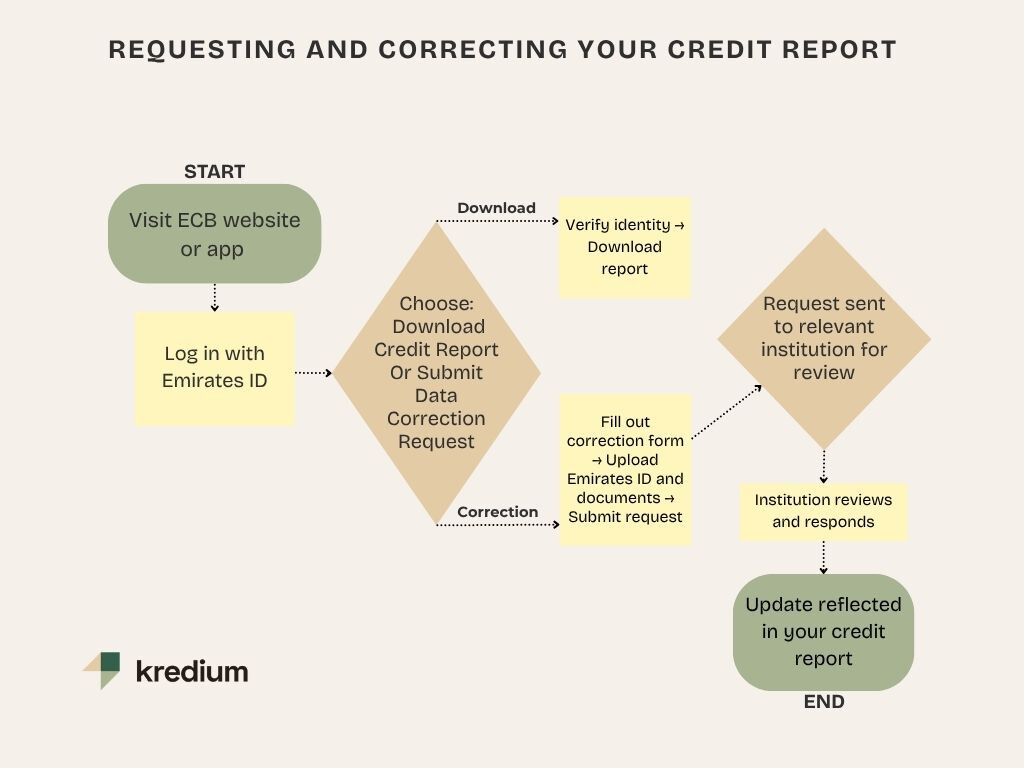

After signing up with your Emirates ID and confirming your identity, you’ll be able to download your report in just a few minutes. If you spot an error in your credit report or need to request a correction, there’s a clear process you can follow through the Etihad Credit Bureau. Here’s a flow chart with information on how to request, review, and correct your credit report:

What is a Credit Score?

Your credit score is like your financial reputation as a number. It sums up your borrowing and payment habits so lenders can quickly understand how reliable you are. In the UAE, the Etihad Credit Bureau generates this score using data from banks, finance companies, and telecom operators.

A score closer to 900 reflects responsible credit use and increases your chances of being approved for loans, mortgages, and credit cards. Scores on the lower end may result in higher interest rates, stricter terms, or even rejection of applications.

Understanding Your Credit Score

Your credit score is a three-digit number derived from the information in your credit report. It ranges from 300 to 900 and is meant to give lenders a quick snapshot of your overall creditworthiness. A higher score means you're seen as a lower risk, while a lower score suggests potential issues with repayment behavior.

The score is influenced by various factors, including how consistently you’ve paid your bills, how much debt you currently owe, the age of your credit accounts, and how frequently you apply for new credit. This number updates regularly based on your ongoing financial activity.

A Table With Credit Score Ranges and What They Mean

Credit Score Range | Rating | What It Means | Impact on Loans & Mortgages |

|---|---|---|---|

300 – 619 | Poor | High risk – many missed payments or defaults | Difficult to get loans; high interest rates |

620 – 679 | Fair | Some missed payments, but improving | Possible loan approval with stricter terms |

680 – 730 | Good | Responsible credit use; mostly on time payments | Easier loan approvals; better interest rates |

731 – 900 | Excellent | Strong credit history; timely payments | Best loan offers and lowest interest rates |

Tip: Aim to keep your score above 680 to improve mortgage chances.

Why it Matters

Your credit score isn’t just a number in the background, it affects lots of financial choices you make. When applying for a mortgage, personal loan, or even a new credit card, banks will typically review your score before making a decision. A strong score can help you secure better interest rates and more favorable terms.

Beyond banking, landlords may check your credit before signing a lease agreement, and telecom companies might use it when offering you a postpaid phone plan. In some sectors, employers may even factor it in when hiring for financially sensitive roles. Therefore, a good credit score opens doors, while a weak one can limit your financial flexibility in the UAE.

Kredium’s mortgage advisors can guide you through your options, even if your score isn’t perfect. Register with us today to get expert support and personalized mortgage solutions.

How to Improve Your Credit Score in The UAE

To improve your credit score, make sure that you are consistent when it comes to your financial habits. The most important step is making all payments on time, including loan installments, credit card bills, and telecom charges. Late or missed payments are one of the fastest ways to lower your score.

To improve your credit score, make sure that you are consistent when it comes to your financial habits. The most important step is making all payments on time, including loan installments, credit card bills, and telecom charges. Late or missed payments are one of the fastest ways to lower your score.

Try to keep your credit card balances low and avoid maxing out your limits. If possible, pay off more than the minimum each month. It's also helpful to limit how often you apply for new credit, as frequent applications can suggest financial stress. Over time, maintaining steady income, reducing outstanding debts, and being consistent with repayments will gradually raise your score and make it easier to qualify for better credit terms.

Looking to boost your score before buying property in Dubai or Abu Dhabi? Get expert insights and property financing advice from Kredium to improve your mortgage approval chances. Register today and let us help you plan ahead with the right financial tools.

Who Uses ECB Reports and Why?

Etihad Credit Bureau reports are used by a range of organizations to estimate how financially trustworthy a person or business is. These reports help institutions make informed decisions based on real financial data rather than guesswork.

Lenders and Banks

Banks and finance companies rely on ECB reports to evaluate loan and credit card applications. Before approving any credit, they check your report to see your current debt levels, repayment history, and credit score. This helps them decide if you’re likely to repay what you borrow, and under what terms. A good credit report can help your business get lower interest rates and better loan deals. But a bad report might lead to loan rejections or stricter terms from lenders.

Employers, Landlords, and Insurers

In some cases, employers, especially in the financial sector, may check your credit history when hiring for roles that involve money management or sensitive financial data. Landlords may also review your report to make sure you’re a reliable tenant who pays rent on time. Some insurers might use the information to understand the financial risk of offering certain policies.

While not all of these groups use credit reports regularly, the data can influence important decisions that go beyond just banking.

ECB for Businesses in The UAE

The Etihad Credit Bureau doesn’t just track individual credit activity, it also collects and reports data on companies operating in the UAE. Business credit reports help banks, suppliers, and service providers assess the creditworthiness of a company. This is especially useful when companies apply for loans, trade credit, or long-term contracts.

By reviewing a business’s payment history, outstanding debts, and overall financial behavior, stakeholders can make more informed decisions and reduce financial risk.

Commercial Credit Reports

A commercial credit report provides a full picture of a company’s financial obligations and credit performance. It includes details on:

corporate loans

credit lines

trade finance

bounced cheques

any legal or financial issues linked to the business

The report also lists the company’s credit partners, such as banks or leasing firms, and highlights any payment delays or defaults. This information helps lenders and vendors understand how responsibly a business manages its financial commitments before entering into agreements.

Benefits for SMEs

For small and medium-sized enterprises (SMEs), a strong commercial credit report can be a valuable asset. It builds credibility and trust with banks, investors, and suppliers. A solid track record makes it easier to secure funding, negotiate better payment terms, or qualify for larger contracts.

Regularly monitoring their credit profile allows SMEs to correct errors, track payment behavior, and stay in good standing. Over time, this can lead to lower borrowing costs and better access to financial opportunities that support growth.

Running an SME and planning to invest in commercial property?

Kredium offers tailored mortgage solutions for entrepreneurs and business owners across the UAE. Speak with our team to explore your financing options.

Cost of ECB Services

Getting your credit information through the Etihad Credit Bureau involves a small fee. The cost depends on the type of report you choose. As of now, an individual credit report is priced at AED 84, while a credit report with a credit score costs AED 105. These fees include VAT and may be subject to change.

Businesses can also request commercial credit reports, with pricing varying based on the complexity and depth of the report. All payments can be made securely online through the ECB website or app.

Is Your Credit Information Secure?

Yes, your credit data is handled with strict confidentiality. The Etihad Credit Bureau follows national data protection laws and uses advanced systems so that personal and business information stays secure at all times. Reports are only shared with authorized institutions, and only with your consent.

Data Protection Measures

The ECB protects your information using encrypted databases, secure access, and regular checks to keep everything safe. Only verified users can access their own reports, and any institution requesting your credit data must have a legal reason and your permission.

In addition, the bureau is regulated by UAE authorities and complies with international best practices in credit reporting and data privacy, giving both individuals and businesses confidence that their information is protected.

FAQs About The Etihad Credit Bureau

Here are answers to some of the most common questions about the Etihad Credit Bureau, its services, and how it affects your financial profile in the UAE.

1. What credit score is considered good in the UAE?

In the UAE, your credit score from the Etihad Credit Bureau goes from 300 up to 900. A score between 680 and 730 is seen as good, while anything above 731 is considered excellent. Scores between 620 and 679 are fair, and anything below 620 is generally viewed as poor. You can check your score or full credit report on the ECB website or app for a small fee.

2. How can you correct errors in your Etihad Credit Bureau report?

You can request a correction through the Etihad Credit Bureau platform by selecting the "Correct My Data" option. You’ll need to complete a short form, provide relevant details, and upload a copy of your Emirates ID.

Once submitted, the bureau forwards your request to the relevant institution, such as a bank or telecom provider for review. Any confirmed corrections will be reflected in your report after the institution responds.

3. What are the consequences of defaulting on a credit card in the UAE?

Failing to repay credit card debt in the UAE can lead to serious legal consequences. Defaulting is considered a criminal offense and may result in fines, travel bans, imprisonment, frozen bank accounts, or even seizure of assets. Lenders may also initiate court proceedings to recover the outstanding amount. It's important to stay on top of payments or seek restructuring options if you're facing financial difficulty.

4. How can you request to remove or correct your name from an Etihad Credit Bureau report?

If your name or any information on your ECB report is incorrect, you can submit a data correction request via the ECB website or app. Just fill out the form, upload your Emirates ID and a recent credit report (within 30 days), and explain the error.

ECB will forward your request to the relevant institution, which must respond within 10 working days. If the issue isn’t resolved, you can follow up by calling 800‑287‑328.

5. How can you clear your credit record in the UAE?

To correct or update your credit record, visit the Al Etihad Credit Bureau (AECB) website or use their mobile app. Select the "Data Correction" option and complete the form with accurate details like your full name, Emirates ID, report date, bank involved, and AECB subject ID. You’ll also need to upload your Emirates ID and a recent credit report (not older than 30 days). Once submitted, the request is reviewed by the concerned institution, and any verified errors will be corrected.

6. Does debt get cleared from your credit report after 7 years in the UAE?

In some cases, if a debt remains unpaid for 7 years, the statute of limitations may prevent creditors from taking legal action to recover it. However, this depends on the type of debt, and there’s no guarantee it will automatically disappear from your credit report. Old debts can still impact your credit history unless formally resolved or corrected.

7. What is the contact number for Etihad Credit Bureau?

You can reach the Etihad Credit Bureau (ECB) by calling their toll-free number: 800‑287‑328 (800‑AECB). This line is available for general inquiries, support with your credit report, or help with data correction requests.

Conclusion

Your credit report and score from the Etihad Credit Bureau can either open doors or create challenges when it comes to financing, especially in the UAE’s competitive real estate market. By understanding how the ECB operates and taking steps to improve your credit profile, you can increase your chances of securing better mortgage terms and smoother financial approvals.

Whether you're just checking your score or actively preparing for a property purchase, Kredium is here to help. Our real estate experts offer guidance, real-time mortgage comparisons, and tailored solutions to make your UAE property journey smarter and more successful.

Photo Credits: Pexels